.

HST - Vote "Yes" to Extinguish

Re: HST - Vote "Yes" to Extinguish

.

- Happyish

Re: HST - Vote "Yes" to Extinguish

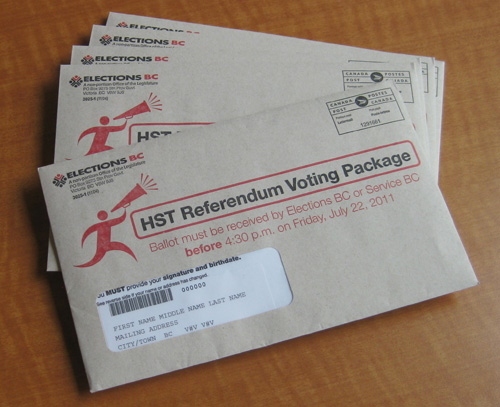

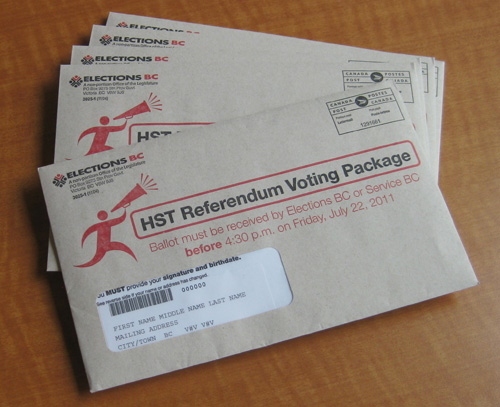

Friday is the final day to have your HST referendum ballot returned to Elections B.C.

New Democrats have 65 reasons for British Columbians to scrap the HST and will be holding last minute rallies today to convince voters to do so.

The deadline to file your ballots is 4:30 p.m. Friday.

At 11 a.m. Thursday, NDP leader Adrian Dix and MLA Jenny Kwan will be at the Collingwood Clock at Joyce and Kingsway to convince Metro Vancouver voters to say “Yes” to extinguish the HST.

Dix will then join Burnaby and Surrey MLAs in the early afternoon to encourage local residents to submit their ballots.

They will be at the corner of Willingdon Road and Halifax Street in Burnaby at 1 p.m., then on to the corner of 152 Street and 101 Avenue in Surrey at 2:30 p.m.

The eleventh hour rallies conclude at 5:30 p.m. at the Woodwards Building on the corner of West Cordova and Abbott Streets in downtown Vancouver.

Last minute voters who unsure if their ballots will make the 4:30 Friday deadline can drop them off at any designated Elections B.C. Collection Centre. Their locations can be found on the Elections B.C. HST Referendum 2011 website.

.

New Democrats have 65 reasons for British Columbians to scrap the HST and will be holding last minute rallies today to convince voters to do so.

The deadline to file your ballots is 4:30 p.m. Friday.

At 11 a.m. Thursday, NDP leader Adrian Dix and MLA Jenny Kwan will be at the Collingwood Clock at Joyce and Kingsway to convince Metro Vancouver voters to say “Yes” to extinguish the HST.

Dix will then join Burnaby and Surrey MLAs in the early afternoon to encourage local residents to submit their ballots.

They will be at the corner of Willingdon Road and Halifax Street in Burnaby at 1 p.m., then on to the corner of 152 Street and 101 Avenue in Surrey at 2:30 p.m.

The eleventh hour rallies conclude at 5:30 p.m. at the Woodwards Building on the corner of West Cordova and Abbott Streets in downtown Vancouver.

Last minute voters who unsure if their ballots will make the 4:30 Friday deadline can drop them off at any designated Elections B.C. Collection Centre. Their locations can be found on the Elections B.C. HST Referendum 2011 website.

.

- Attachments

-

- Vote Yes Fight HST poster.jpg (19.26 KiB) Viewed 375310 times

- A taxpayer

Re: HST - Vote "Yes" to Extinguish

Just Say Yes!: Getting Past the Government's HST Schtick

Vote YES to Scrap the HST

I encourage you to watch the video and share it as widely as possible.

.

.

Secrets of the HST Referendum

What the BC gov't won't tell you about the tax and who's behind the campaign pushing it.

.

Vote YES to Scrap the HST

I encourage you to watch the video and share it as widely as possible.

.

.

Secrets of the HST Referendum

What the BC gov't won't tell you about the tax and who's behind the campaign pushing it.

.

- Attachments

-

- Vote Yes Fight HST poster.jpg (19.26 KiB) Viewed 375415 times

- BC FED

Re: HST - Vote "Yes" to Extinguish

Someone has taken ALL the "Say Yes to Extinguish HST" Signs from around Commercial Drive area. For the past few weeks someone was knocking a couple of them over in front of my apartment building and I kept putting them up...Now they are gone and I can find even one sign around the neighbourhood. GGGRRRRR!!! People need to rally and make signs and carry them..but unfortunately people are more concerned with what is on tonights reality show hit than what is going on around them. It is very sad.

- Attachments

-

- Vote Yes Fight HST poster.jpg (19.26 KiB) Viewed 375463 times

- HST fighter on The Drive

Re: HST - Vote "Yes" to Extinguish

Burned by B.C.'s toxic HST debate

By Jim Stanford

"The fact that the Clark government's Frankenstein HST hybrid will significantly reduce provincial sales tax revenue at a time when public services are already under intense fiscal pressure is a powerful and principled reason to throw the whole package out in the referendum, and start the debate from scratch."

I may live in Ontario, but I know enough about B.C. politics to know that you have to be very careful what you step into. That's why I tried to steer clear of any public comment about the debate over the B.C. HST that's been raging out there.

So I was very surprised when my ears started ringing, from the other side of the Rockies, a couple of weeks ago. My phone started ringing, too, with people calling to ask why on earth I had endorsed the HST.

I've never endorsed the HST. That claim, made by business-funded HST advocates in B.C. trying to drive a wedge between unions in B.C. and in Ontario, is blatantly false.

It all started when David Robertson, who is a spokesperson for the Smart Tax Alliance, started reading aloud on the radio from some personal emails that he and I had exchanged back in 2006 -- long before the idea of the HST was ever sprung on an unsuspecting public by Gordon Campbell.

[Don't confuse this David Robertson with my recently retired colleague at CAW David Robertson. That David Robertson is a fine person and Canada's greatest union expert on work organization issues.]

My email exchange with Robertson started after he and I met at a policy conference. He wrote me afterwards to ask if the CAW would join a coalition of groups lobbying for a harmonized tax in Ontario. I turned down his request.

A couple of weeks ago, Mr. Robertson quoted selectively from those e-mails on CKNW radio to make it sound like I was endorsing the HST.

I called him on June 23, not even remembering that we had met before, and asked him where on earth he got these quotes. When I learned he was quoting from five-year-old personal emails, written in an entirely different context, I was furious. I told him I thought it was highly unethical to read from five-year-old personal emails on a radio show. I also informed him that neither I nor the CAW had ever endorsed the account HST in either Ontario or B.C., and asked him to stop saying those things. I wrote to CKNW (and their pro-HST commentator Michael Campbell, in particular, who was repeating Robertson's false claims) to inform them of the falsehood.

Now this week, Robertson's group, the Smart Tax Alliance, found a scanned copy of an internal memo I wrote in 2009 to our local union leaders in Ontario. I don't know where they got it -- they won't tell me. It was an internal CAW memo; we didn't publish it. The Smart Tax Alliance's PR director told me on the phone it was delivered to them by someone who found it on the web, but would not divulge who sent it to them. (You get three guesses, and the first two don't count.) And Mr. Robertson's claim that it has now mysteriously disappeared from the CAW website is false; it was never there. The Smart Tax Alliance posted it on their site, and it's now the most famous (infamous?) internal memo I ever wrote! Never mind the silly cloak and dagger: I definitely wrote the memo, it was intended internally for our Ontario leaders, but now it's out there. Whatever.

In the memo, I explain to our leaders in Ontario how the HST works, some of the benefits of the value-added tax model, but also some of the costs of the Ontario proposal: like the fact that the tax is now applied to new sectors of the economy that were exempt from the former PST, and the fact that sales taxes in general are regressive. The memo concludes that the most progressive tax policy would be to abolish sales taxes altogether, and replace the lost revenue with higher personal and corporate incomes taxes (a policy option which, obviously, would face it sown policy challenges).

Most importantly, the memo is explicit that the CAW did not endorse the HST in Ontario, nor did we condemn it. It was also explicit that its analysis did not apply to B.C., given the big differences between the provinces. The main point of my memo was to discourage our activists here from jumping on board any anti-HST bandwagon in this province.

Quoting selectively again from my memo, the Smart Tax Alliance, Mr. Robertson, and other HST proponents in B.C. (including Tony Wilson in an on-line commentary) falsely claimed that I and the CAW support the HST. This is a blatantly false claim. The Smart Tax Alliance and Tony Wilson both corrected their errors and withdrew that claim from their respective on-line commentaries. I'm not sure about Mr. Robertson; he was still claiming that the CAW supported the HST later this week, even though he was personally informed weeks ago that neither I nor CAW have endorsed the HST anywhere.

In 20 years of life as a public economist, where as most of you know I've engaged in all kinds of often heated debates, I have never experienced such unprofessional and unethical behaviour from a debating opponent.

My recommendation to our Ontario leaders to stay out of the HST fray here was motivated as much by political reasons, as economic ones. In Ontario, the anti-HST movement was very much tied up with an anti-government, anti-tax message. Our view was that movement would ultimately do more harm than good. For the most part, the labour movement in Ontario stayed away from the HST, and the protests here were pretty small and short-lived anyway.

At any rate, when I write an internal memo listing costs and benefits of a certain policy, you can hardly conclude that I or my organization have endorsed that policy. That's nonsense. And at any rate, I don't determine CAW policy anyway. I give advice. It's our elected leaders who set policy. If I write an internal memo saying I think the CAW should use pink toilet paper, and it somehow gets posted on the web, that doesn't imply that the CAW has a policy in favour of pink toilet paper.

In B.C., where the HST proposal itself is different, where the economy is different, and where the politics are (very) different, the labour movement (including the CAW locals in B.C.) have been actively engaged in the fight to reject the Liberal government's revised HST proposal in the current referendum (this means, perversely, voting "YES").

The B.C. labour movement's opposition to the HST has been carefully framed in the context of a broader demand to restructure the provincial tax system on a more progressive basis. The debate is thus much bigger than "HST or PST." It's about the whole question of how to fund first-class public services, with a system of fair and efficient taxes.

I don't see a contradiction between that approach, and what our union decided in Ontario, because of the many differences between the policy, the economy, and the politics of the two provinces. In fact, the two positions are motivated by the same ultimate goal: solidifying the fiscal base of first-class public services.

One big difference between Ontario and B.C. is the relative importance in the two provinces of manufacturing vs. resources. It is in manufacturing that the problem of "cascading" -- a tax on a tax -- is most severe because of the more intensive and complex supply chain that inputs to the sector. This is not such an issue in resources (where value-added in the sector is a much higher share of total revenues).

Moreover, there's an important issue about how companies will respond to the money they save with an HST, especially in exports. In manufacturing, producers compete on price -- so savings on input tax credits could make a difference to prices and hence to the volume of exports (and resulting employment). In resources, however, prices are generally set by world commodities markets. In that case, cost savings the company enjoys will not affect prices or volumes; they will likely show up as bigger profits.

Another important sectoral difference is the hospitality sector. In Ontario, the hospitality and restaurant sector already paid PST, so the HST wasn't a big shock. In B.C., it will face provincial sales taxes for the first time. (Full disclosure: the CAW represents many hospitality workers in B.C., so that's an important issue for us.) In contrast, the main new sector that was hit by the HST in Ontario was home heating; the government brought in a temporary rebate that slightly more than offsets those higher costs (for a while, anyway).

In terms of overall fiscal impact, the biggest concern in my mind about the Clark government's revised HST proposal is that it will significantly reduce the total revenues collected form the provincial sales tax. Why? In a desperate attempt to salvage the policy, the government's proposal would cut the rate by 2 points (cutting the provincial portion from 7 per cent to 5 per cent). If our main concern (as I suggested) is fighting to preserve the fiscal basis for public programs during an era of austerity, then the B.C. HST will do the exact opposite.

I suspect that the controversy in B.C. largely stems from the process by which the policy was introduced and handled. The Campbell government sprang the HST on the public, after promising not to. The resulting outrage was enormous and understandable. Now the Clark government has fiddled with their plan, trying to bribe the voters with their own money by cutting the rate, and throwing in some other face-saving trinkets. The B.C. vote is thus not a referendum on HST vs. PST; it's referendum on the direction of overall tax policy, and the economic and political credibility of the government itself.

After all, the sales tax is just one piece of a bigger, ultimate question of the structure of our overall tax system. You can't think about the HST, without looking at what's happening to the rest of the tax system. What we're ultimately concerned with is how we collect the taxes we need to pay for great public services, in a manner that is both fair and economically efficient.

The B.C. office of the CCPA has made that point very effectively, with a powerful new study that documents the overwhelmingly regressive impact of cumulative tax changes there in recent years. The lowest income quintile in the province now pays 14-15 per cent of their income in total provincial taxes, while the highest income quintile pays just 11 per cent. The HST is a small piece of that problem; cuts to progressive personal and corporate income taxes have been the main culprits. But widespread populist anger about the injustice of the tax burden has surely played into populist anti-HST sentiment. And for that reason the HST debate can't be separated from the bigger issue. To that end, the B.C. Federation of Labour's effort to clearly link its fight against the HST to its broader fight for fair taxes is important and bang-on.

I think my full analysis of the HST debate in Ontario is reasonable and nuanced, and I stand by everything I said in it (repeating the strong and explicit proviso that it applies only to Ontario, and not to B.C.). We could have a healthy and honest dialogue on the left about the HST and all the issues associated with it. I am not the only person on the left to be cautious about the politics of campaigning against the HST; Hugh Mackenzie and Matt Fodor have raised similar points. On the other hand, many good people on the left, like our own Erin Weir, have been strong and clear in opposing the HST. (Erin buddy, you'd be a very popular guy out in B.C. right now if the ITUC could find their way to deliver you there in the near future!)

But with propogandists like Mr. Robertson on the prowl, there's no room for healthy and honest dialogue. Don't ever write a policy brief that lists the pros and cons of any issue; folks like Robertson will come along, cite only the points he likes, and then sign you up as an endorser of his position. It's a shameful way of working, that does immense disservice to the honest dialogue that is essential to good policy-making. No wonder everything seems black and white in B.C.; there's no room for grey.

At any rate, the leadership of the B.C. unions have carefully weighed all these issues, and put their emphasis on fighting the government's tax package as part of a broader campaign for well-funded, fairly-funded public services, and I support them entirely. The vote in B.C. is not a referendum on the abstract principle of a value-added versus a cascading sales tax. It's been all muddied up with other issues: broadening the base, cutting the rate, cutting corporate income taxes, and everything else that's been thrown into the haphazard Clark tax stew. In short, it's a referendum on the shattered credibility and regressivity of the government's whole approach to taxes. And sadly, the unethical, take-no-prisoners approach of the Smart Tax Alliance and its spokespersons is quite consistent with the duplicity of the provincial government's whole approach.

(Side point: There are no rules governing campaign funding in the HST debate in B.C. HST advocates can collect as much money as they can from business backers, without declaring where it came from, and what it was spent on. That is the stinky future of democracy in our plutocracy.)

For me, here's the last nail in the coffin. The fact that the Clark government's Frankenstein HST hybrid will significantly reduce provincial sales tax revenue at a time when public services are already under intense fiscal pressure, is a powerful and principled reason to throw the whole package out in the referendum, and start the whole tax debate from scratch.

This article was first posted on The Progressive Economics Forum.

By Jim Stanford

"The fact that the Clark government's Frankenstein HST hybrid will significantly reduce provincial sales tax revenue at a time when public services are already under intense fiscal pressure is a powerful and principled reason to throw the whole package out in the referendum, and start the debate from scratch."

I may live in Ontario, but I know enough about B.C. politics to know that you have to be very careful what you step into. That's why I tried to steer clear of any public comment about the debate over the B.C. HST that's been raging out there.

So I was very surprised when my ears started ringing, from the other side of the Rockies, a couple of weeks ago. My phone started ringing, too, with people calling to ask why on earth I had endorsed the HST.

I've never endorsed the HST. That claim, made by business-funded HST advocates in B.C. trying to drive a wedge between unions in B.C. and in Ontario, is blatantly false.

It all started when David Robertson, who is a spokesperson for the Smart Tax Alliance, started reading aloud on the radio from some personal emails that he and I had exchanged back in 2006 -- long before the idea of the HST was ever sprung on an unsuspecting public by Gordon Campbell.

[Don't confuse this David Robertson with my recently retired colleague at CAW David Robertson. That David Robertson is a fine person and Canada's greatest union expert on work organization issues.]

My email exchange with Robertson started after he and I met at a policy conference. He wrote me afterwards to ask if the CAW would join a coalition of groups lobbying for a harmonized tax in Ontario. I turned down his request.

A couple of weeks ago, Mr. Robertson quoted selectively from those e-mails on CKNW radio to make it sound like I was endorsing the HST.

I called him on June 23, not even remembering that we had met before, and asked him where on earth he got these quotes. When I learned he was quoting from five-year-old personal emails, written in an entirely different context, I was furious. I told him I thought it was highly unethical to read from five-year-old personal emails on a radio show. I also informed him that neither I nor the CAW had ever endorsed the account HST in either Ontario or B.C., and asked him to stop saying those things. I wrote to CKNW (and their pro-HST commentator Michael Campbell, in particular, who was repeating Robertson's false claims) to inform them of the falsehood.

Now this week, Robertson's group, the Smart Tax Alliance, found a scanned copy of an internal memo I wrote in 2009 to our local union leaders in Ontario. I don't know where they got it -- they won't tell me. It was an internal CAW memo; we didn't publish it. The Smart Tax Alliance's PR director told me on the phone it was delivered to them by someone who found it on the web, but would not divulge who sent it to them. (You get three guesses, and the first two don't count.) And Mr. Robertson's claim that it has now mysteriously disappeared from the CAW website is false; it was never there. The Smart Tax Alliance posted it on their site, and it's now the most famous (infamous?) internal memo I ever wrote! Never mind the silly cloak and dagger: I definitely wrote the memo, it was intended internally for our Ontario leaders, but now it's out there. Whatever.

In the memo, I explain to our leaders in Ontario how the HST works, some of the benefits of the value-added tax model, but also some of the costs of the Ontario proposal: like the fact that the tax is now applied to new sectors of the economy that were exempt from the former PST, and the fact that sales taxes in general are regressive. The memo concludes that the most progressive tax policy would be to abolish sales taxes altogether, and replace the lost revenue with higher personal and corporate incomes taxes (a policy option which, obviously, would face it sown policy challenges).

Most importantly, the memo is explicit that the CAW did not endorse the HST in Ontario, nor did we condemn it. It was also explicit that its analysis did not apply to B.C., given the big differences between the provinces. The main point of my memo was to discourage our activists here from jumping on board any anti-HST bandwagon in this province.

Quoting selectively again from my memo, the Smart Tax Alliance, Mr. Robertson, and other HST proponents in B.C. (including Tony Wilson in an on-line commentary) falsely claimed that I and the CAW support the HST. This is a blatantly false claim. The Smart Tax Alliance and Tony Wilson both corrected their errors and withdrew that claim from their respective on-line commentaries. I'm not sure about Mr. Robertson; he was still claiming that the CAW supported the HST later this week, even though he was personally informed weeks ago that neither I nor CAW have endorsed the HST anywhere.

In 20 years of life as a public economist, where as most of you know I've engaged in all kinds of often heated debates, I have never experienced such unprofessional and unethical behaviour from a debating opponent.

My recommendation to our Ontario leaders to stay out of the HST fray here was motivated as much by political reasons, as economic ones. In Ontario, the anti-HST movement was very much tied up with an anti-government, anti-tax message. Our view was that movement would ultimately do more harm than good. For the most part, the labour movement in Ontario stayed away from the HST, and the protests here were pretty small and short-lived anyway.

At any rate, when I write an internal memo listing costs and benefits of a certain policy, you can hardly conclude that I or my organization have endorsed that policy. That's nonsense. And at any rate, I don't determine CAW policy anyway. I give advice. It's our elected leaders who set policy. If I write an internal memo saying I think the CAW should use pink toilet paper, and it somehow gets posted on the web, that doesn't imply that the CAW has a policy in favour of pink toilet paper.

In B.C., where the HST proposal itself is different, where the economy is different, and where the politics are (very) different, the labour movement (including the CAW locals in B.C.) have been actively engaged in the fight to reject the Liberal government's revised HST proposal in the current referendum (this means, perversely, voting "YES").

The B.C. labour movement's opposition to the HST has been carefully framed in the context of a broader demand to restructure the provincial tax system on a more progressive basis. The debate is thus much bigger than "HST or PST." It's about the whole question of how to fund first-class public services, with a system of fair and efficient taxes.

I don't see a contradiction between that approach, and what our union decided in Ontario, because of the many differences between the policy, the economy, and the politics of the two provinces. In fact, the two positions are motivated by the same ultimate goal: solidifying the fiscal base of first-class public services.

One big difference between Ontario and B.C. is the relative importance in the two provinces of manufacturing vs. resources. It is in manufacturing that the problem of "cascading" -- a tax on a tax -- is most severe because of the more intensive and complex supply chain that inputs to the sector. This is not such an issue in resources (where value-added in the sector is a much higher share of total revenues).

Moreover, there's an important issue about how companies will respond to the money they save with an HST, especially in exports. In manufacturing, producers compete on price -- so savings on input tax credits could make a difference to prices and hence to the volume of exports (and resulting employment). In resources, however, prices are generally set by world commodities markets. In that case, cost savings the company enjoys will not affect prices or volumes; they will likely show up as bigger profits.

Another important sectoral difference is the hospitality sector. In Ontario, the hospitality and restaurant sector already paid PST, so the HST wasn't a big shock. In B.C., it will face provincial sales taxes for the first time. (Full disclosure: the CAW represents many hospitality workers in B.C., so that's an important issue for us.) In contrast, the main new sector that was hit by the HST in Ontario was home heating; the government brought in a temporary rebate that slightly more than offsets those higher costs (for a while, anyway).

In terms of overall fiscal impact, the biggest concern in my mind about the Clark government's revised HST proposal is that it will significantly reduce the total revenues collected form the provincial sales tax. Why? In a desperate attempt to salvage the policy, the government's proposal would cut the rate by 2 points (cutting the provincial portion from 7 per cent to 5 per cent). If our main concern (as I suggested) is fighting to preserve the fiscal basis for public programs during an era of austerity, then the B.C. HST will do the exact opposite.

I suspect that the controversy in B.C. largely stems from the process by which the policy was introduced and handled. The Campbell government sprang the HST on the public, after promising not to. The resulting outrage was enormous and understandable. Now the Clark government has fiddled with their plan, trying to bribe the voters with their own money by cutting the rate, and throwing in some other face-saving trinkets. The B.C. vote is thus not a referendum on HST vs. PST; it's referendum on the direction of overall tax policy, and the economic and political credibility of the government itself.

After all, the sales tax is just one piece of a bigger, ultimate question of the structure of our overall tax system. You can't think about the HST, without looking at what's happening to the rest of the tax system. What we're ultimately concerned with is how we collect the taxes we need to pay for great public services, in a manner that is both fair and economically efficient.

The B.C. office of the CCPA has made that point very effectively, with a powerful new study that documents the overwhelmingly regressive impact of cumulative tax changes there in recent years. The lowest income quintile in the province now pays 14-15 per cent of their income in total provincial taxes, while the highest income quintile pays just 11 per cent. The HST is a small piece of that problem; cuts to progressive personal and corporate income taxes have been the main culprits. But widespread populist anger about the injustice of the tax burden has surely played into populist anti-HST sentiment. And for that reason the HST debate can't be separated from the bigger issue. To that end, the B.C. Federation of Labour's effort to clearly link its fight against the HST to its broader fight for fair taxes is important and bang-on.

I think my full analysis of the HST debate in Ontario is reasonable and nuanced, and I stand by everything I said in it (repeating the strong and explicit proviso that it applies only to Ontario, and not to B.C.). We could have a healthy and honest dialogue on the left about the HST and all the issues associated with it. I am not the only person on the left to be cautious about the politics of campaigning against the HST; Hugh Mackenzie and Matt Fodor have raised similar points. On the other hand, many good people on the left, like our own Erin Weir, have been strong and clear in opposing the HST. (Erin buddy, you'd be a very popular guy out in B.C. right now if the ITUC could find their way to deliver you there in the near future!)

But with propogandists like Mr. Robertson on the prowl, there's no room for healthy and honest dialogue. Don't ever write a policy brief that lists the pros and cons of any issue; folks like Robertson will come along, cite only the points he likes, and then sign you up as an endorser of his position. It's a shameful way of working, that does immense disservice to the honest dialogue that is essential to good policy-making. No wonder everything seems black and white in B.C.; there's no room for grey.

At any rate, the leadership of the B.C. unions have carefully weighed all these issues, and put their emphasis on fighting the government's tax package as part of a broader campaign for well-funded, fairly-funded public services, and I support them entirely. The vote in B.C. is not a referendum on the abstract principle of a value-added versus a cascading sales tax. It's been all muddied up with other issues: broadening the base, cutting the rate, cutting corporate income taxes, and everything else that's been thrown into the haphazard Clark tax stew. In short, it's a referendum on the shattered credibility and regressivity of the government's whole approach to taxes. And sadly, the unethical, take-no-prisoners approach of the Smart Tax Alliance and its spokespersons is quite consistent with the duplicity of the provincial government's whole approach.

(Side point: There are no rules governing campaign funding in the HST debate in B.C. HST advocates can collect as much money as they can from business backers, without declaring where it came from, and what it was spent on. That is the stinky future of democracy in our plutocracy.)

For me, here's the last nail in the coffin. The fact that the Clark government's Frankenstein HST hybrid will significantly reduce provincial sales tax revenue at a time when public services are already under intense fiscal pressure, is a powerful and principled reason to throw the whole package out in the referendum, and start the whole tax debate from scratch.

This article was first posted on The Progressive Economics Forum.

- Attachments

-

- Vote Yes Fight HST poster.jpg (19.26 KiB) Viewed 375474 times

- Facts

Re: HST - Vote "Yes" to Extinguish

Latest lies of BC’s neo-liberals

The BC Liberal “myths” about the HST just keep piling up.

We don’t have the budget to fight the lies, we need your help. Keep the message going by forwarding this link to all the people you know and ask them to do the same.

Following is their latest Top Seven – all new and misleading as ever – HST Myths:

1. The HST is now 10% – False

The HST is 12% and will not be 10% for three years – if ever. There will be an election before that, and even if the HST were to miraculously drop to 10% – it will still apply to hundreds more goods and services than a 12% PST/GST for a consumer tax increase of $1.6B per year. And who says it won’t go right back up again later?

2. The HST will lower taxes – False

This one is hilarious. The HST increases taxes for British Columbians by $2.8 Billion per year. That’s an average annual increase of $500 per person – or $1208 per average family – forever. Finance Minister Falcon says if his side loses he may disregard the result and expand the PST to items previously exempt – and that’s illegal. Do you really trust this guy to cut the rate if he wins?

3. The HST will save you money – False

And the tooth fairy is going to leave you a quarter under your pillow too. To get their numbers to show the HST actually “saving” you money they are calculating only “routine purchases” and that 90% of what you pay in HST will be passed back to you in lower prices. Have you seen lower prices?… We didn’t think so.

4. The HST benefits seniors – False

Seniors and people on fixed incomes are some of the hardest hit by the HST. A one time rebate of $175 if you vote in favour of their tax in exchange for paying it for the next 10-30 years of your retirement is a deal only a snake oil salesman would offer. Why take $175 when you can vote to cancel the HST and keep all your money? How dumb do they think we are?

5. The HST benefits families – False

Next to seniors, working families are hardest hit by the HST because they are among the largest consumers and have dependent children. Bribes of $175 per child when your cost is closer to $400 a year each makes you wonder if they think all of us failed math as badly as they did. And what about a single mom with two kids going to college? She gets nothing while the Premier and Finance Minister who earn big six figure salaries get the rebate. Nice.

6. Business will pay more so you can pay less – False

A temporary increase of 2% in corporate taxes will be passed on to consumers with increased prices. Either way you pay the final bill whether it’s in HST or higher prices.

7. We will owe $1.6 Billion if we cancel the HST – False

The “Independent Panel” says the HST generated $850 million more than budgeted. Setting aside that is the biggest tax grab in history, it means government already has $850 million to repay Ottawa. BC has only received $1B, and Ottawa collected $300M more in corporate taxes under the HST than under the PST. So it’s a wash. And keeping the HST would cost British Columbians alot more than killing it – over $28 Billion in new taxes in just 10 years.

Vote YES to extinguish the HST and save your province, your democracy, and your money!

.

The BC Liberal “myths” about the HST just keep piling up.

We don’t have the budget to fight the lies, we need your help. Keep the message going by forwarding this link to all the people you know and ask them to do the same.

Following is their latest Top Seven – all new and misleading as ever – HST Myths:

1. The HST is now 10% – False

The HST is 12% and will not be 10% for three years – if ever. There will be an election before that, and even if the HST were to miraculously drop to 10% – it will still apply to hundreds more goods and services than a 12% PST/GST for a consumer tax increase of $1.6B per year. And who says it won’t go right back up again later?

2. The HST will lower taxes – False

This one is hilarious. The HST increases taxes for British Columbians by $2.8 Billion per year. That’s an average annual increase of $500 per person – or $1208 per average family – forever. Finance Minister Falcon says if his side loses he may disregard the result and expand the PST to items previously exempt – and that’s illegal. Do you really trust this guy to cut the rate if he wins?

3. The HST will save you money – False

And the tooth fairy is going to leave you a quarter under your pillow too. To get their numbers to show the HST actually “saving” you money they are calculating only “routine purchases” and that 90% of what you pay in HST will be passed back to you in lower prices. Have you seen lower prices?… We didn’t think so.

4. The HST benefits seniors – False

Seniors and people on fixed incomes are some of the hardest hit by the HST. A one time rebate of $175 if you vote in favour of their tax in exchange for paying it for the next 10-30 years of your retirement is a deal only a snake oil salesman would offer. Why take $175 when you can vote to cancel the HST and keep all your money? How dumb do they think we are?

5. The HST benefits families – False

Next to seniors, working families are hardest hit by the HST because they are among the largest consumers and have dependent children. Bribes of $175 per child when your cost is closer to $400 a year each makes you wonder if they think all of us failed math as badly as they did. And what about a single mom with two kids going to college? She gets nothing while the Premier and Finance Minister who earn big six figure salaries get the rebate. Nice.

6. Business will pay more so you can pay less – False

A temporary increase of 2% in corporate taxes will be passed on to consumers with increased prices. Either way you pay the final bill whether it’s in HST or higher prices.

7. We will owe $1.6 Billion if we cancel the HST – False

The “Independent Panel” says the HST generated $850 million more than budgeted. Setting aside that is the biggest tax grab in history, it means government already has $850 million to repay Ottawa. BC has only received $1B, and Ottawa collected $300M more in corporate taxes under the HST than under the PST. So it’s a wash. And keeping the HST would cost British Columbians alot more than killing it – over $28 Billion in new taxes in just 10 years.

Vote YES to extinguish the HST and save your province, your democracy, and your money!

.

- Attachments

-

- Vote Yes Fight HST poster.jpg (19.26 KiB) Viewed 375456 times

- Standup

Re: HST - Vote "Yes" to Extinguish

HST in British Columbia Causes 12,000 More Full Time Jobs to Vanish in June

I was hoping that someone else was going to write about it, in particular I was prodding David Schreck to post something on the matter, however.......

Here it is Sunday, July 10th and I still haven`t listened to Friday`s cutting ledge show on CKNW, it`s the first time in ages I haven`t listened to the show, lately the stooges have been so bad and partisan that even I had to change the channel, I heard the promo for the show and it sounded like they were going teacher bashing, what else is new!

Sometimes there is no need to go looking for a story, they just arrive, for here it was, a couple of days ago I was listening to the news, radio news, I always have the radio on as background noise and occasionally you hear items in the news that spawn a story, only sometimes it`s not what they say it`s what they don`t say is where the real story hides, CKNW and the BC Liberals PAB are so used to jumping on any good news and spinning, all political all the time, any report, any study, any tidbit of good news that the BC Liberal Public Affairs Bureau division can spin will be spun...All in an effort to shore up a lame duck Christy Clark and tired caucus....

So anyway, I hear a blurb about Stats Canada June jobs report on CKNW.... CKNW reported that Canada added 28,000 jobs in June,..So my ears perk up, after all, here we are in the middle of the HST referendum, jobs numbers should be front and center in this debate, in particular how many jobs has BC gained or lost since the implementation of the HST on July 1st/2010.....My ears perked up because I was waiting for CKNW to report on the BC numbers in the latest Stats Canada jobs report...But none were forthcoming.....So, I said to myself.....There must be something more to that story, surely if BC had gained any jobs the BC Liberal PABLUM machine would be sending out press releases left right and center but again, another jobs report from Stats Canada and the silence from PAB was deafening......So I went to the source.(Stats Canada)

The Jim Dinning report on the HST...Well first off, Jack Mintz for 12K$ wrote that BC would gain by 2020 an extra 130,000 jobs by implementing the HST, the Mintz report was debunked and tossed, then the Jim Dinning report came out claiming the HST by 2020 BC would add an extra 23,000 jobs to BC`s economy, ....The latest BC Liberal spin coming out from rightwing mouth piece Alise Mills is...."The HST is about saving jobs in BC"......Hilarious, the BC Liberals are now flip-flopping on the job numbers, for now it`s not about creating jobs but about keeping jobs in the resource sector, that`s how pathetic this HST argument has become.......Back to the Jim Dinning job numbers, what is so pathetic about about that number(23,000 jobs by 2020) is....It`s puny, a number so small that even smaller provinces like Alberta can add that many jobs month over month...Saskatchewan, Alberta, these smaller provinces can add that many jobs or more in a month and it happens all the time, bigger provinces like Quebec, Ontario, British Columbia can add jobs by 20..30...40 thousand new jobs month over month so when Jim Dinning comes out with a number of 23,000 thousand new jobs by 2020 it`s laughable....Which brings me to the latest Stats Canada jobs report.....

But before I get there, I reported that BC lost full time jobs in the last Stats Canada jobs report(May Jobs report) but they were mostly offset by temporary workers who were hired through out the province during the Canuck playoff run, restaurants, bar servers, liquor stores and various other retailers hired staff for the Canuck run, the net result was a Stats Canada (May) jobs report that was for the most part flat, no gain, no loss, but that was then and this is now for the June Stats Canada jobs report is out and British Columbia has lost a staggering....Drum roll please..

12,000 Full time jobs....BC lost another 12,000 thousand full time jobs, there were 2000 part time jobs added for a net total of 10,000 fewer jobs in BC month over month....At a time of traditional summer jobs and youth hiring BC continues to bleed jobs.....Here are some highlights from the latest Stats Canada jobs report.

Ontario gains 30,000 jobs in June.....Alberta gains 27,000 jobs in June...British Columbia loses 10,000 jobs in June.

Doesn`t that number just glare, Jim Dinning`s group is claiming 23,000 additional new jobs by 2020...When Alberta can beat that number in 1 month....And there is no HST in Alberta!

Well well well, pretty bad numbers folks, BC is a summer tourist hub, well it was at one time, we lost more jobs, exactly what Jack Mintz originally predicted would happen is indeed happening, you see folks, in Jack Mintz`s original report to CD Howe(2008) on the HST(now deleted from CD Howe`s archives)..."The HST would result in job losses for the first several years"snip....

The Stats Canada jobs report....It`s even worse than you imagine, for Governments do a new thing with unemployment numbers, for now when your EI runs out, even if you haven`t got a job yet you are now considered....."No longer looking for work" and no longer on the unemployment list.....For in the latest Stats Canada jobs report....

BC`s labour force shrunk by over 24,000 persons, in other words, month over month BC`s labour force shrunk by 24,000 workers, we lost 12,000 full time jobs while adding 2000 part-time jobs...In a nutshell, 24,000 people had their unemployment insurance run out, plus another 12,000 workers lost full time jobs....You can look at the Stats Canada jobs report details here...

Perhaps Alise Mills or Mike Jagger of the Smart Tax Alliance or even the shill David Robertson would like to explain the latest Stats Canada jobs report....

The Art of Distraction......Canada gains 28,000 jobs in June,.....But hiding behind that curtain British Columbia is bleeding jobs, another 12,000 full time jobs gone, the story behind the story, no one reported the BC job numbers, how come, if BC gained jobs the BC Liberal media buzzards would be all over it, perhaps Adrian Dix noticed .....Perhaps Chris Delaney and his group might want to make this known, perhaps I`m the only one paying attention.

The Silence from the Pro-HST spinners Mike Jagger and the Smart Tax Alliance on this latest Stats Canada jobs report is..

Deafening!

The Straight Goods

Cheers Eyes Wide Open

Posted by Grant G at 2:44 PM

.

I was hoping that someone else was going to write about it, in particular I was prodding David Schreck to post something on the matter, however.......

Here it is Sunday, July 10th and I still haven`t listened to Friday`s cutting ledge show on CKNW, it`s the first time in ages I haven`t listened to the show, lately the stooges have been so bad and partisan that even I had to change the channel, I heard the promo for the show and it sounded like they were going teacher bashing, what else is new!

Sometimes there is no need to go looking for a story, they just arrive, for here it was, a couple of days ago I was listening to the news, radio news, I always have the radio on as background noise and occasionally you hear items in the news that spawn a story, only sometimes it`s not what they say it`s what they don`t say is where the real story hides, CKNW and the BC Liberals PAB are so used to jumping on any good news and spinning, all political all the time, any report, any study, any tidbit of good news that the BC Liberal Public Affairs Bureau division can spin will be spun...All in an effort to shore up a lame duck Christy Clark and tired caucus....

So anyway, I hear a blurb about Stats Canada June jobs report on CKNW.... CKNW reported that Canada added 28,000 jobs in June,..So my ears perk up, after all, here we are in the middle of the HST referendum, jobs numbers should be front and center in this debate, in particular how many jobs has BC gained or lost since the implementation of the HST on July 1st/2010.....My ears perked up because I was waiting for CKNW to report on the BC numbers in the latest Stats Canada jobs report...But none were forthcoming.....So, I said to myself.....There must be something more to that story, surely if BC had gained any jobs the BC Liberal PABLUM machine would be sending out press releases left right and center but again, another jobs report from Stats Canada and the silence from PAB was deafening......So I went to the source.(Stats Canada)

The Jim Dinning report on the HST...Well first off, Jack Mintz for 12K$ wrote that BC would gain by 2020 an extra 130,000 jobs by implementing the HST, the Mintz report was debunked and tossed, then the Jim Dinning report came out claiming the HST by 2020 BC would add an extra 23,000 jobs to BC`s economy, ....The latest BC Liberal spin coming out from rightwing mouth piece Alise Mills is...."The HST is about saving jobs in BC"......Hilarious, the BC Liberals are now flip-flopping on the job numbers, for now it`s not about creating jobs but about keeping jobs in the resource sector, that`s how pathetic this HST argument has become.......Back to the Jim Dinning job numbers, what is so pathetic about about that number(23,000 jobs by 2020) is....It`s puny, a number so small that even smaller provinces like Alberta can add that many jobs month over month...Saskatchewan, Alberta, these smaller provinces can add that many jobs or more in a month and it happens all the time, bigger provinces like Quebec, Ontario, British Columbia can add jobs by 20..30...40 thousand new jobs month over month so when Jim Dinning comes out with a number of 23,000 thousand new jobs by 2020 it`s laughable....Which brings me to the latest Stats Canada jobs report.....

But before I get there, I reported that BC lost full time jobs in the last Stats Canada jobs report(May Jobs report) but they were mostly offset by temporary workers who were hired through out the province during the Canuck playoff run, restaurants, bar servers, liquor stores and various other retailers hired staff for the Canuck run, the net result was a Stats Canada (May) jobs report that was for the most part flat, no gain, no loss, but that was then and this is now for the June Stats Canada jobs report is out and British Columbia has lost a staggering....Drum roll please..

12,000 Full time jobs....BC lost another 12,000 thousand full time jobs, there were 2000 part time jobs added for a net total of 10,000 fewer jobs in BC month over month....At a time of traditional summer jobs and youth hiring BC continues to bleed jobs.....Here are some highlights from the latest Stats Canada jobs report.

Ontario gains 30,000 jobs in June.....Alberta gains 27,000 jobs in June...British Columbia loses 10,000 jobs in June.

Doesn`t that number just glare, Jim Dinning`s group is claiming 23,000 additional new jobs by 2020...When Alberta can beat that number in 1 month....And there is no HST in Alberta!

Well well well, pretty bad numbers folks, BC is a summer tourist hub, well it was at one time, we lost more jobs, exactly what Jack Mintz originally predicted would happen is indeed happening, you see folks, in Jack Mintz`s original report to CD Howe(2008) on the HST(now deleted from CD Howe`s archives)..."The HST would result in job losses for the first several years"snip....

The Stats Canada jobs report....It`s even worse than you imagine, for Governments do a new thing with unemployment numbers, for now when your EI runs out, even if you haven`t got a job yet you are now considered....."No longer looking for work" and no longer on the unemployment list.....For in the latest Stats Canada jobs report....

BC`s labour force shrunk by over 24,000 persons, in other words, month over month BC`s labour force shrunk by 24,000 workers, we lost 12,000 full time jobs while adding 2000 part-time jobs...In a nutshell, 24,000 people had their unemployment insurance run out, plus another 12,000 workers lost full time jobs....You can look at the Stats Canada jobs report details here...

Perhaps Alise Mills or Mike Jagger of the Smart Tax Alliance or even the shill David Robertson would like to explain the latest Stats Canada jobs report....

The Art of Distraction......Canada gains 28,000 jobs in June,.....But hiding behind that curtain British Columbia is bleeding jobs, another 12,000 full time jobs gone, the story behind the story, no one reported the BC job numbers, how come, if BC gained jobs the BC Liberal media buzzards would be all over it, perhaps Adrian Dix noticed .....Perhaps Chris Delaney and his group might want to make this known, perhaps I`m the only one paying attention.

The Silence from the Pro-HST spinners Mike Jagger and the Smart Tax Alliance on this latest Stats Canada jobs report is..

Deafening!

The Straight Goods

Cheers Eyes Wide Open

Posted by Grant G at 2:44 PM

.

- Attachments

-

- Vote Yes Fight HST poster.jpg (19.26 KiB) Viewed 375538 times

- Read this

Re: HST - Vote "Yes" to Extinguish

Canada: Anti-HST Signs Vandalised In BC

Vancouver - "No" means "Yes" in BC’s HST hanky panky. Referendum battle heats up as ballots delivered. Business group fights to keep tax. Government accused of running deceptive ads. Former BC finance minister Carole Taylor speaks out against HST.

As Canada Post promised, the BC HST referendum ballots were delivered to most Vancouver residents last week, citizens that voted in the last provincial election. Other qualifying citizens that were missed must contact Elections BC to get their referendum kits. The deadline for receipt of ballots has been extended to August 5th.

CTV Television reported yesterday that some people had received extra ballots, while some had not received any at all, raising questions about the accuracy of the referendum and the viability of the new deadline. Canada Post is still trying to clear the backlog of mail accumulated during the postal strike-lockout in June before the Parliament's back-to-work legislation.

Bill Vander Zalm, the former BC Premier that has mobilised public opinion against the tax, says government ads that claim the tax will be reduced from 12 to 10-percent are misleading and deceptive. He says the ads don’t mention that the reduction will take place over a period of three years and it will only go into effect if and when the governing BC Liberals are re-elected in the next election.

It was reported that anti-HST lawn signs were vandalised around BC last week. “Say YES” was covered by vinyl decals that said “Say NO” with the same colours as the lawn sign, making the change almost imperceptible to the naked eye. About a hundred signs disappeared in Vancouver. Vander Zalm says this is a criminal act that ought to be investigated by the police. RCMP says it will be investigated as a mischief but not as an offence under the Canada Elections Act, since the matter falls under provincial jurisdiction.

For the past two weeks businesses representing the pro-HST side have been running an intensive telemarketing campaign to persuade the electorate to keep the tax. My mother, an old age pensioner, has already received three telephone calls from the so-called Smart Tax Alliance. Callers told her she should vote no to keep the tax because the tax will be good for her.

Whether the tax will be good for you depends on if you’re a business owner with an HST number, since registered businesses can get the HST paid refunded. The dispute arises from the fact that several goods and services exempt from provincial taxation, such as restaurant food and some groceries, are taxable under the HST scheme. In BC's HST hanky panky No means Yes to tax, and Yes means No to HST, since Elections BC in its wisdom has drafted the following as the referendum question: Are you in favour of extinguishing the HST (Harmonized Sales Tax) and reinstating the PST (Provincial Sales Tax) in conjunction with the GST (Goods and Services Tax) ?

Whether the tax is good for the economy is a matter of philosophical debate. The anti-tax movement claims it's bad for small homegrown business since it discourages consumption, while the Smart Tax Alliance says anything that's good for corporate profits is good for jobs and the overall economy.

BC’s former finance minister Carole Taylor spoke against the tax last week. She told a tv news panel “This particular tax takes the tax off businesses – it takes $1.8-billion off of businesses – and puts it on consumers.

”As Austin Powers would have put it: “It depends on who’s shagging whom, baby.”

.

Vancouver - "No" means "Yes" in BC’s HST hanky panky. Referendum battle heats up as ballots delivered. Business group fights to keep tax. Government accused of running deceptive ads. Former BC finance minister Carole Taylor speaks out against HST.

As Canada Post promised, the BC HST referendum ballots were delivered to most Vancouver residents last week, citizens that voted in the last provincial election. Other qualifying citizens that were missed must contact Elections BC to get their referendum kits. The deadline for receipt of ballots has been extended to August 5th.

CTV Television reported yesterday that some people had received extra ballots, while some had not received any at all, raising questions about the accuracy of the referendum and the viability of the new deadline. Canada Post is still trying to clear the backlog of mail accumulated during the postal strike-lockout in June before the Parliament's back-to-work legislation.

Bill Vander Zalm, the former BC Premier that has mobilised public opinion against the tax, says government ads that claim the tax will be reduced from 12 to 10-percent are misleading and deceptive. He says the ads don’t mention that the reduction will take place over a period of three years and it will only go into effect if and when the governing BC Liberals are re-elected in the next election.

It was reported that anti-HST lawn signs were vandalised around BC last week. “Say YES” was covered by vinyl decals that said “Say NO” with the same colours as the lawn sign, making the change almost imperceptible to the naked eye. About a hundred signs disappeared in Vancouver. Vander Zalm says this is a criminal act that ought to be investigated by the police. RCMP says it will be investigated as a mischief but not as an offence under the Canada Elections Act, since the matter falls under provincial jurisdiction.

For the past two weeks businesses representing the pro-HST side have been running an intensive telemarketing campaign to persuade the electorate to keep the tax. My mother, an old age pensioner, has already received three telephone calls from the so-called Smart Tax Alliance. Callers told her she should vote no to keep the tax because the tax will be good for her.

Whether the tax will be good for you depends on if you’re a business owner with an HST number, since registered businesses can get the HST paid refunded. The dispute arises from the fact that several goods and services exempt from provincial taxation, such as restaurant food and some groceries, are taxable under the HST scheme. In BC's HST hanky panky No means Yes to tax, and Yes means No to HST, since Elections BC in its wisdom has drafted the following as the referendum question: Are you in favour of extinguishing the HST (Harmonized Sales Tax) and reinstating the PST (Provincial Sales Tax) in conjunction with the GST (Goods and Services Tax) ?

Whether the tax is good for the economy is a matter of philosophical debate. The anti-tax movement claims it's bad for small homegrown business since it discourages consumption, while the Smart Tax Alliance says anything that's good for corporate profits is good for jobs and the overall economy.

BC’s former finance minister Carole Taylor spoke against the tax last week. She told a tv news panel “This particular tax takes the tax off businesses – it takes $1.8-billion off of businesses – and puts it on consumers.

”As Austin Powers would have put it: “It depends on who’s shagging whom, baby.”

.

- Attachments

-

- Vote Yes Fight HST poster.jpg (19.26 KiB) Viewed 375578 times

- In the Media

Re: HST - Vote "Yes" to Extinguish

Dix says say no by voting yes on HST ballot

"So we have a tax shift onto working families that hurts local economies. We have a government that has misled us repeatedly on the question."

We have a government that is going ahead with a fiscal plan that means major cuts to health care. All of those are good reasons to vote yes to scrap the HST. The final one is this. This is our referendum and it's a referendum that Ms. Clark and (Finance Minister) Falcon are trying to buy. The Liberal Party does not have the right to do that. I think it's important for our democracy that we say Yes to scrap the HST, because if the Liberals get away with this, there is nothing they can't get away with. We have to say 'no' to that by saying 'yes' to scrapping the HST."

Local resident Mary Begg said "the HST has caused expenses to go up, and it is obvious that businesses such as Sundance, (and) the local theatre, to name a few, are now getting less from me. The HST's impact on me hurts the businesses in my community."

Dix urged people to vote yes and to return their ballots as soon as they arrive.

"I think if we have a high turnout, the Yes side to scrap the HST will win, so part of the reason I'm traveling around and meeting with people is to make sure that they know about the referendum, to make sure that they return their ballots as soon as possible after they get their ballots," he said. "The government wants a low turnout where they can use their political machine and government money to win a low-turnout referendum."

"So we have a tax shift onto working families that hurts local economies. We have a government that has misled us repeatedly on the question."

We have a government that is going ahead with a fiscal plan that means major cuts to health care. All of those are good reasons to vote yes to scrap the HST. The final one is this. This is our referendum and it's a referendum that Ms. Clark and (Finance Minister) Falcon are trying to buy. The Liberal Party does not have the right to do that. I think it's important for our democracy that we say Yes to scrap the HST, because if the Liberals get away with this, there is nothing they can't get away with. We have to say 'no' to that by saying 'yes' to scrapping the HST."

Local resident Mary Begg said "the HST has caused expenses to go up, and it is obvious that businesses such as Sundance, (and) the local theatre, to name a few, are now getting less from me. The HST's impact on me hurts the businesses in my community."

Dix urged people to vote yes and to return their ballots as soon as they arrive.

"I think if we have a high turnout, the Yes side to scrap the HST will win, so part of the reason I'm traveling around and meeting with people is to make sure that they know about the referendum, to make sure that they return their ballots as soon as possible after they get their ballots," he said. "The government wants a low turnout where they can use their political machine and government money to win a low-turnout referendum."

- Attachments

-

- Vote Yes Fight HST poster.jpg (19.26 KiB) Viewed 375604 times

- Dix

Re: HST - Vote "Yes" to Extinguish

Yes means no in HST referendum

‘We’ll sell you two kinds of red herring,

Dark brown, and ball-bearing.

But yes, we have no bananas

We have no bananas today.’

— 1922 Broadway song

Are you going to vote Yes in order to say no to the HST? Or No to say yes?

Let’s be clear — and the ballot is in the mail — yes means no and no means yes in this referendum.

It's in the mail.

.

One of the more significant challenges facing the Fight HST side of the vote is confusion over wording of the ballot, which is: “Are you in favour of extinguishing the HST (Harmonized Sales Tax) and reinstating the PST (Provincial Sales Tax) in conjunction with the GST (Goods and Services Tax)? (Yes/No).”

The question itself is clear enough, but voting Yes against something is counter-intuitive. It’s a little like the old Frank Silver/Irving Cohn song, “Yes! We Have No Bananas.”

Mind you, it cuts both ways. HST supporters might be equally confused.

An Angus Reid survey released last weekend says close to 20 per cent believe that if the Yes side wins, the HST will stay in place, at 10 per cent. A third think if No wins, it will stay at 12 per cent.

Among Christy Clark, Adrian Dix and Bill Vander Zalm, Vander Zalm is the most trusted.

Over all, though, a lot more people support the HST than they did a year ago — 44 per cent now compared to only 18 per cent.

The Reid survey report believes confusion over the meaning of the referendum question “could definitely affect the final outcome.”

The anti-HST group is fighting with lawn signs that say, “Yes — extinguish the HST,” while the pro side is using a mass media campaign with a “Vote No to higher taxes” message. It’s a reference to the Liberals’ promise to reduce the tax over time if it survives the referendum, but leaves the impression it’s all about saving consumers money.

I received my HST Referendum Voters Guide in the mailbox a few days ago. In it, the government claims the HST is “better for jobs and the economy.” And a pro-HST statement says the tax will create 24,400 jobs over what the PST/GST would create.

It goes on to say the HST “protects” seniors and low-income families via a rebate.

The anti-HST Yes side, though, declares that ditching the tax and reverting to the GST/PST “will save British Columbians hundreds to thousands of dollars a year.”

It points out that under the HST consumers pay more on restaurant food, cable TV, phone service, haircuts and so on. It “kills jobs and hurts the economy.”

Besides which, it’s bad for democracy.

Who does one believe? The Smart Tax Alliance, a coalition primarily of businesses, concluded on Friday that the latest employment numbers prove the HST is working — B.C. gained 5,200 jobs in May. “The HST is helping B.C. recover from the recession and build a stronger economy.”

But then, there was the original claim from economist Jack Mintz that the HST would create 113,000 jobs, an estimate that has since been significantly downsized.

There’s no evidence, of course, that the HST is responsible for new jobs at all, whichever numbers you use, but most businesses support the tax.

Consumers were, in turn, supposed to benefit through lower prices passed on by those whose products we buy. What I’d like to see, before I mail in my vote, is some evidence that this has actually happened.

‘We’ll sell you two kinds of red herring,

Dark brown, and ball-bearing.

But yes, we have no bananas

We have no bananas today.’

— 1922 Broadway song

Are you going to vote Yes in order to say no to the HST? Or No to say yes?

Let’s be clear — and the ballot is in the mail — yes means no and no means yes in this referendum.

It's in the mail.

.

One of the more significant challenges facing the Fight HST side of the vote is confusion over wording of the ballot, which is: “Are you in favour of extinguishing the HST (Harmonized Sales Tax) and reinstating the PST (Provincial Sales Tax) in conjunction with the GST (Goods and Services Tax)? (Yes/No).”

The question itself is clear enough, but voting Yes against something is counter-intuitive. It’s a little like the old Frank Silver/Irving Cohn song, “Yes! We Have No Bananas.”

Mind you, it cuts both ways. HST supporters might be equally confused.

An Angus Reid survey released last weekend says close to 20 per cent believe that if the Yes side wins, the HST will stay in place, at 10 per cent. A third think if No wins, it will stay at 12 per cent.

Among Christy Clark, Adrian Dix and Bill Vander Zalm, Vander Zalm is the most trusted.

Over all, though, a lot more people support the HST than they did a year ago — 44 per cent now compared to only 18 per cent.

The Reid survey report believes confusion over the meaning of the referendum question “could definitely affect the final outcome.”

The anti-HST group is fighting with lawn signs that say, “Yes — extinguish the HST,” while the pro side is using a mass media campaign with a “Vote No to higher taxes” message. It’s a reference to the Liberals’ promise to reduce the tax over time if it survives the referendum, but leaves the impression it’s all about saving consumers money.

I received my HST Referendum Voters Guide in the mailbox a few days ago. In it, the government claims the HST is “better for jobs and the economy.” And a pro-HST statement says the tax will create 24,400 jobs over what the PST/GST would create.

It goes on to say the HST “protects” seniors and low-income families via a rebate.

The anti-HST Yes side, though, declares that ditching the tax and reverting to the GST/PST “will save British Columbians hundreds to thousands of dollars a year.”

It points out that under the HST consumers pay more on restaurant food, cable TV, phone service, haircuts and so on. It “kills jobs and hurts the economy.”

Besides which, it’s bad for democracy.

Who does one believe? The Smart Tax Alliance, a coalition primarily of businesses, concluded on Friday that the latest employment numbers prove the HST is working — B.C. gained 5,200 jobs in May. “The HST is helping B.C. recover from the recession and build a stronger economy.”

But then, there was the original claim from economist Jack Mintz that the HST would create 113,000 jobs, an estimate that has since been significantly downsized.

There’s no evidence, of course, that the HST is responsible for new jobs at all, whichever numbers you use, but most businesses support the tax.

Consumers were, in turn, supposed to benefit through lower prices passed on by those whose products we buy. What I’d like to see, before I mail in my vote, is some evidence that this has actually happened.

- Attachments

-

- Vote Yes Fight HST poster.jpg (19.26 KiB) Viewed 375622 times

- The Armchair Mayor

40 posts

• Page 1 of 4 • 1, 2, 3, 4